Continuation Vehicles: From Innovation to Mainstream - The Evolution of Private Equity's Liquidity Solution

The private equity landscape has undergone a fundamental transformation in recent years, with continuation vehicles emerging as a critical tool for managing portfolio assets and addressing liquidity challenges.

What began as an exception has become the rule, with these structures now representing a mainstream solution that is reshaping how general partners (GPs) and limited partners (LPs) think about value creation and exit strategies.

The Rise of Continuation Vehicles

The concept of continuation vehicles is straightforward: instead of selling a portfolio company to a third party or taking it public, a GP transfers the asset into a new fund vehicle, allowing existing LPs to either roll their interests forward or exit at a negotiated valuation.

This mechanism has grown exponentially, with U.S. and European private equity exits to continuation vehicles reaching 96 transactions in 2024, representing a nearly 13% increase from the previous year.

The growth trajectory is even more striking when viewed through a broader lens.

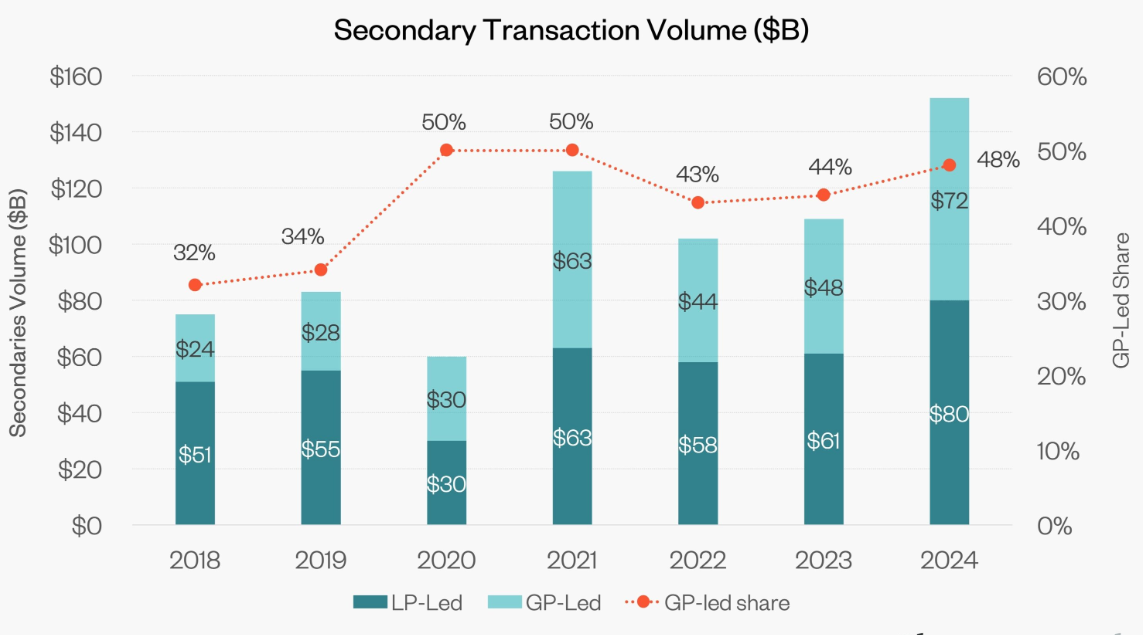

Private equity secondaries now exceed $160 billion annually and are projected to reach $200 billion by the end of 2025.

This remarkable expansion reflects not just market dynamics, but a fundamental shift in how the industry approaches asset management and value realisation.

Credit: Chronograph.pe

Source: 2024 Lazard Secondary Market Report

Why Continuation Vehicles Have Become Essential

Several converging factors have elevated continuation vehicles from niche tool to essential strategy:

Extended Value Creation Timelines

The traditional private equity model of acquiring, improving, and exiting within 5-7 years no longer aligns with the reality of building truly transformative businesses.

Many portfolio companies require additional time to fully realise their potential, particularly those undergoing significant operational transformations or pursuing complex market expansion strategies.

Continuation vehicles provide GPs with the runway to complete these value creation initiatives without forcing premature exits.

Market Timing Flexibility

Exit markets can be unpredictable, with IPO windows closing unexpectedly and strategic buyer appetite fluctuating based on economic conditions. Rather than accepting suboptimal valuations, GPs can use continuation vehicles to weather market volatility while maintaining momentum in portfolio companies.

This approach has proven particularly valuable during periods of market dislocation.

LP Optionality and Liquidity Management

From the LP perspective, continuation vehicles offer unprecedented flexibility.

Investors facing their own liquidity needs or portfolio rebalancing requirements can exit their positions at a negotiated price, while those who believe in the continued upside potential can roll their stakes forward.

This optionality addresses one of the fundamental tensions in private equity: the mismatch between fund term limits and individual LP liquidity requirements.

The Emergence of CV-Squared: Continuation Vehicles on Continuation Vehicles

Perhaps the most intriguing development in this space is the emergence of second-generation continuation vehicles, continuation vehicles on continuation vehicles, or "CV-squared."

This phenomenon reflects both the success of the initial continuation vehicle strategy and the ongoing need for flexibility in private markets.

When a GP establishes a continuation vehicle, they typically project a new value creation timeline of 3-5 years. However, just as the original fund may have required extension, these continuation vehicles themselves may benefit from additional time.

Rather than viewing this as a failure of strategy, forward-thinking GPs and LPs recognise it as an acknowledgment that building exceptional businesses often takes longer than any predetermined timeline suggests.

The CV-squared structure demonstrates the maturation of the continuation vehicle market.

What was once an emergency measure has become a deliberate strategy, and the industry has developed the sophistication to layer these structures effectively.

Addressing the Challenges and Criticisms

Despite their growing prevalence, continuation vehicles are not without controversy.

Critics raise several legitimate concerns:

Valuation Conflicts

The GP is simultaneously representing the selling fund (seeking the highest price) and the buying fund (seeking the lowest price). This inherent conflict requires robust governance mechanisms, independent valuation processes, and careful alignment of interests to ensure fairness to all parties.

Extended Hold Periods

Some market observers worry that continuation vehicles allow GPs to avoid accountability for underperforming assets by perpetually extending hold periods rather than accepting disappointing exits. This concern is partially addressed by the requirement for new capital to enter at the continuation vehicle stage, providing market-based validation of valuations.

LP Fatigue

As continuation vehicles become more common, LPs may face repeated decisions about whether to roll forward or exit their positions in the same underlying asset.

This creates analytical burden and potential decision fatigue, particularly for smaller institutional investors with limited resources.

Case Studies: Lessons from the Market

The evolution of continuation vehicles is best understood through real-world examples that illustrate both the opportunities and challenges of this approach.

Case Study 1: The Performance Premium

Recent research from Morgan Stanley and HarbourVest provides compelling evidence for the continuation vehicle thesis. Analysis of the past five years of publicly available data demonstrates that continuation funds outperform traditional buyout funds across all quartiles, while exhibiting significantly lower risk profiles.

The data shows continuation funds with a 9% loss ratio compared to 19% for traditional buyouts, less than half the risk.

This performance differential stems from several structural advantages.

First, continuation vehicles benefit from positive selection bias, as GPs typically choose their highest-performing portfolio companies for these transactions.

Second, they eliminate change-of-control risk and the blind pool risk inherent in traditional fund commitments, as investors can evaluate specific, known assets.

Third, the transaction structures often optimize GP-LP alignment through mechanisms like sponsor reinvestment and competitive bidding processes.

Case Study 2: Sale-Leaseback Structures for Additional Liquidity

An innovative application of continuation vehicles involves integrating sale-leaseback transactions to address complex liquidity needs.

In one recent transaction executed by Ascension Advisory, a private equity sponsor used portfolio sale-leaseback proceeds to generate the capital necessary to close a continuation vehicle.

The portfolio company in question was asset-intensive, with substantial real estate holdings. Rather than forcing a full sale of the business or requiring existing LPs to commit significantly more capital, the sponsor structured a sale-leaseback of key properties.

This transaction served multiple purposes: it provided immediate liquidity to exiting LPs, reduced the capital required from new investors in the continuation vehicle, and allowed the portfolio company to maintain operational control of critical assets while freeing capital for growth initiatives.

This case demonstrates the increasing sophistication of continuation vehicle structures and the willingness of market participants to layer creative financing solutions to optimize outcomes for all stakeholders.

Case Study 3: The Cautionary Tale of Leverage and Market Timing

Not all continuation vehicle stories end positively, and the market has witnessed instructive failures that highlight the risks of these structures.

While specific company names illustrate these challenges, the patterns are clear:

Continuation vehicles work best when driven by genuine value creation opportunities rather than attempts to delay recognising poor performance.

In several high-profile technology sector cases, GPs initially considered continuation vehicles for businesses acquired at peak valuations with substantial leverage.

When market conditions shifted and revenue growth slowed, the overleveraged capital structures proved unsustainable.

In these instances, GPs faced difficult decisions: inject additional capital to support the businesses, restructure the debt, or ultimately cede control to creditors.

The lesson for the industry is clear: continuation vehicles should extend successful value creation trajectories, not serve as mechanisms to avoid accountability for struggling investments.

The requirement for new capital to validate valuations provides an important market discipline, but only if LPs and secondary buyers perform rigorous diligence and resist the temptation to rely solely on sponsor reputation.

Case Study 4: Sector-Specific Success in Software

Leading software-focused private equity firms have demonstrated particular success with continuation vehicles, reflecting the sector's unique characteristics.

Software businesses often require extended periods to fully develop recurring revenue models, expand internationally, and achieve optimal scale.

These timelines frequently exceed traditional fund life cycles.

Several major software investors have successfully deployed continuation vehicles to extend hold periods for their highest-conviction assets. These transactions typically feature strong financial performance from the underlying portfolio companies, clear articulation of remaining value creation opportunities (such as geographic expansion or product line extensions), and robust governance mechanisms to address conflicts of interest.

The software sector's predictable revenue streams and high margins make these businesses particularly suitable for continuation vehicles.

Secondary buyers can underwrite future performance with greater confidence, and the reduced execution risk commands premium valuations compared to earlier-stage investments.

Best Practices and Market Standards

As the continuation vehicle market has matured, several best practices have emerged, informed by both successful transactions and cautionary tales:

Robust Governance Frameworks

Leading GPs establish independent committees to evaluate continuation vehicle transactions, ensuring that both selling and buying LPs are treated fairly. These committees often include independent directors or advisors with no economic interest in the outcome.

Transparent Communication

Successful continuation vehicles are characterised by clear, detailed communication about the rationale for the transaction, the value creation plan for the continuation period, and the governance mechanisms in place to protect LP interests.

Alignment of Interests

GPs who commit significant additional capital or agree to reduced fees during the continuation period demonstrate genuine conviction in the ongoing thesis, helping to align interests with LPs who choose to roll forward.

The Future of Continuation Vehicles

Looking ahead, continuation vehicles are poised to become an even more integral part of the private equity ecosystem.

Several trends will shape their evolution:

Expansion into Private Credit

While private equity secondaries dominate today, private credit secondaries are growing rapidly and could reach $40 billion by 2027.

Continuation vehicles in credit strategies will likely follow a similar trajectory, providing flexibility in managing performing loans and credit assets.

Regulatory Evolution

Increased regulatory scrutiny of continuation vehicles is likely, particularly around conflicts of interest and LP protection.

However, thoughtful regulation could ultimately strengthen the market by establishing clear standards and increasing LP confidence.

Integration with GP-Led Transactions

Continuation vehicles are increasingly viewed as one tool within a broader toolkit of GP-led secondary transactions. The boundaries between continuation vehicles, strip sales, and preferred equity solutions are becoming more fluid, with GPs selecting the optimal structure for each situation.

Conclusion: A Permanent Feature of the Private Markets Landscape

Continuation vehicles have evolved from a rarely used exception to a mainstream liquidity and portfolio management tool. Their growth reflects fundamental changes in how value is created in private equity and the increasing sophistication of both GPs and LPs in managing long-term investments.

The emergence of CV-squared transactions demonstrates that the market has moved beyond viewing continuation vehicles as a one-time solution and now recognises them as a flexible framework for optimizing outcomes over extended periods. While challenges around conflicts of interest and governance remain, the benefits of enhanced flexibility, LP optionality, and extended value creation timelines have proven compelling.

For GPs, continuation vehicles offer a pathway to maximise value in their best assets without being constrained by arbitrary fund timelines.

For LPs, they provide liquidity options and the ability to make nuanced decisions about their exposure to specific assets and strategies.

For portfolio companies, they enable long-term strategic planning without the disruption of ownership changes.

As we move forward, continuation vehicles will continue to evolve, but their role as a permanent feature of the private markets landscape is now well established.

The firms that master this tool—balancing the interests of diverse stakeholders while executing disciplined value creation strategies, will be best positioned to generate superior returns in an increasingly complex investment environment.

Member discussion