Post-close pitfalls: Preventing PE value erosion

The post-close trap is private equity’s under-acknowledged crisis, in which problems occur soon after deals have been agreed and before many firms can react.

Within the industry, more value is lost within the first 100 days of an acquisition than during the rest of the entire hold period.

The clock ticks down on value immediately, and failure to act fast is costly.

Integration failures, talent exodus and regulatory blind spots are just some of the issues firms need to address swiftly.

What systems can firms deploy to navigate this period? How have these positively impacted financial performances?

Discover more about the systems firms are using to manage risks early on, and learn about Plutus-Noremo’s proprietary integrated framework.

The mood changes instantly. Champagne flutes clink as the deal closes, but by Monday morning, the dominos start to fall. Senior talent hands in notice, the integration taskforce looks daunted, systems hiccup, customers ask anxious questions, and regulatory risks emerge silently, like cracks in a dam you can't quite see until it bursts.

Each "minor" issue compounds, and value ebbs away faster than you can track.

Welcome to the post-close trap, an under-acknowledged crisis in private equity where swift, compounding problems drain value before most teams truly react. This is the industry's unspoken reality: more value is destroyed in the first 100 days than during the entire hold period that follows.

Deployment ≠ Victory: The Industry's Delusion

Despite what press releases proclaim, getting a deal over the line does not guarantee value capture.

Everyone in private equity knows the truth but avoids saying it: closing the deal is not the same as capturing the value.

Yet firms act as if deployment equals victory. Most PE incentives celebrate transaction speed, not sustained excellence. Integration gets delegated, underfunded, or treated as a checklist formality.

Meanwhile, the clock starts ticking, and value begins quietly leaking.

The industry quietly acknowledges that 70% of M&A transactions fall short of synergy targets, with underperforming integrations pulling IRRs down by as much as 12 percentage points.

Execution, especially in the first 100 days, makes or breaks the investment thesis.

The maths is brutal: your thesis does not fail at due diligence; it fails in the first 100 days post-close.

Unfortunately, old habits persist. Integration is treated as an afterthought or tick-the-box exercise, and the clock on value erosion starts ticking immediately.

Anatomy of Value Destruction: The 'Red Corner'

When the deal closes, the real test begins.

The red corner exposes the speed at which value can erode if post-close execution lacks discipline: talent departures, rushed or paralysed integration, customer friction, weak systems, and creeping regulatory risk all quietly accumulate, threatening to undo the investment thesis long before the full hold period matures.

In this early phase, the size of the problem is less important than the velocity of response. Without a living, cross-functional playbook and real-time risk monitoring, even solid due diligence can be undone by operational missteps.

Several actual case studies illustrate this point:

Talent exodus

In a well-documented case, a mid-market retail platform saw a 20% attrition rate among mid-level managers within the first quarter post-close. The loss of institutional knowledge led to delayed product launches and a 15% drop in operational efficiency, with estimated synergy losses of $10-15 million in the first year.

Integration paralysis

A manufacturing roll-up with a 200+ page integration plan struggled to execute, as the plan became a reporting ritual rather than a roadmap. Decision bottlenecks and misaligned priorities caused a 30% delay in synergy realisation, with the integration timeline stretching from 100 to 140 days.

Customer churn

A services business experienced a 5-point drop in NPS and a 10% increase in churn within the first 90 days post-close. Competitors capitalised on the disruption, and revenue retention became the primary battleground for value protection.

System integration failures

A healthcare services merger faced a mid-cutover system outage due to data migration issues, resulting in two months of downtime and remediation costs that exceeded initial synergy estimates by 25%.

Regulatory blind spots

A cross-border platform encountered governance gaps mid-integration, triggering regulatory inquiries and a $5 million remediation cost, distracting management from core integration activities.

Blue Corner: The Integrated Antidote

Excellence in post-close execution is a durable capability, not a one-off milestone.

From week one, due diligence crystallizes into a living, resilient playbook where commercial and technology teams operate as a single, accountable unit. Real-time data feeds guide decision-making, enabling rapid adaptation to emerging risks and opportunities while preserving critical talent, sustaining customer relationships, and ensuring system readiness.

Governance is proactive, with continuous learning loops that turn every new insight into improved execution and guarded value. In this frame, resilience becomes the core engine that converts due diligence into durable, portfolio-wide value, even amid volatility and disruption.

Leading firms deploy integrated, systematic countermeasures to neutralise these risks.

Early knowledge mapping and retention incentives can reduce attrition by up to 40% in the first 90 days, preserving operational continuity and accelerating milestone achievement. Agile, living roadmaps with joint commercial-technical ownership can shorten integration timelines by 20-30% and improve decision velocity, ensuring that plans remain actionable and responsive to real-world data. Dedicated customer war rooms with real-time sentiment analytics and rapid intervention protocols stabilise revenue and protect relationships during transition, reducing churn by up to 50%.

Embedding compliance architecture into the integration plan from day one, with standardised governance across portfolios, minimises regulatory inquiries and ensures smoother audits.

The Turning Point: engineering post-close resilience

Top performers don't have better luck; they have better systems.

The unpredictable dynamics shaping today's private equity landscape are impossible to ignore. Markets are being buffeted by geopolitical shocks, tech bubble corrections, and a series of rapid macroeconomic shifts, each introducing new layers of risk and uncertainty into the deal cycle.

With PE holding periods lengthening and integration timelines extending, the firms that invest in integrated commercial-technical due diligence frameworks are far better equipped to absorb shocks, adapt quickly, and safeguard value, even when the road ahead is anything but smooth.

Excellence can look like:

- Commercial-technology collaboration from day one: Due diligence teams construct real-time integration playbooks, stress-testing assumptions against technical realities before the deal even closes.

- Knowledge capture as a core asset: Retention strategies target not just executives but the unseen experts who hold operational memory.

- Agile, living integration plans: Plans that evolve weekly as real data replaces assumption.

- Customer war rooms: Keeping eyes fixed on revenue stability when everyone else turns inward.

- Automated risk intelligence: Monitoring integration stress through live dashboards rather than rear-view metrics.

These practices consistently deliver 20% higher IRR realisation rates, 30% faster integration timelines, and 25% uplift in synergy achievement.

Cross-functional collaboration from day 1 yields faster realisation of the investment thesis, with joint diligence-to-execution ownership, rapid decision-making, and continuous learning loops.

The Plutus-Noremo Blueprint: from insight to action

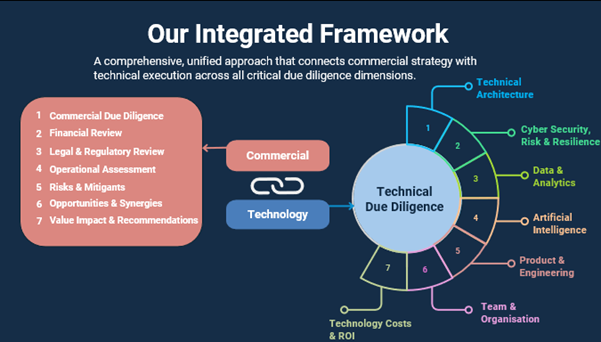

Where most consultancies stop at the due diligence report, Plutus and Noremo bridge execution with a proprietary, integrated framework.

Image credit: Plutus-Noremo Alliance 2025

Due diligence findings become a live, operational roadmap: each risk, dependency, and synergy is assigned owners, metrics, and deliverables, tracked weekly, not quarterly.

Traditional advisory flows look like this: Commercial DD validates the thesis, Technical DD inspects the systems, Legal DD checks compliance. Then the data room closes, and the integration team starts blind.

Plutus-Noremo closes that fatal gap:

- Dual Accountability: Commercial and technical strategists own milestones from pre-close to steady state.

- Real-Time Monitoring: Dashboards give leadership and operators instant access to changes in talent risk, customer churn, and system health.

- War Room Culture: Cross-functional squads respond to flagged issues, ensuring no risk snowballs into value destruction.

- Institutional Capability: Repeatable frameworks institutionalize integration expertise across every deal cycle.

As one practitioner puts it, "The unpredictable nature of the market that we're seeing now, whether due to geopolitical or tech bubbles" means that the combined commercial-tech due diligence 'blue team', the integrated antidote, will help PE firms be more prepared and less impacted by the 'bumps' as deal cycles are getting stretched longer by a few years in some cases.

Quantifying the Impact

Independent studies and Plutus-Noremo data show consistent, repeatable gains:

|

Metric |

Benefit Realised |

|

IRR realisation |

+20% |

|

Integration speed |

30% faster |

|

Synergy achievement |

+25% |

|

Churn & staff attrition |

40-50% reduction |

|

Unplanned downtime/remediation |

-85% |

Source: Plutus Consulting Group

On a £100m acquisition, this can mean tens of millions in value preserved or accelerated. In current markets, where rates are high and mistakes are costly, this is a genuine competitive edge.

Conclusion

Value destruction is never random; it results from disconnects between due diligence and execution.

And so is value creation.

Plutus and Noremo exist to bridge those gaps, delivering on the urgent promise of integration-led value creation. In a landscape defined by volatility, competing on capability is the only path to sustainable outperformance.

You have built flawless investment committees, world-class origination, and robust exit planning. But unless your integration capability matches that rigour, your portfolio's value is vulnerable. In a market where leverage costs more, multiples are high, and execution is everything, integration capability is not optional, it is your next competitive edge.

For a portfolio resilience audit, executive integration workshop, or a live demo of the Plutus-Noremo platform, contact us today.

Start capturing the value others let slip away.

Member discussion