The Next Frontier: Outlearning Value Destruction

A New Era in Private Equity Value Creation

Private equity is entering its most intellectually challenging era. The easy gains from leverage and multiple expansion are behind us, replaced by a more complex but sustainable path: operational mastery, institutional learning, and strategic resilience.

Today's landscape exposes firms to invisible risks that undermine returns and reputations.

These risks, rooted in overlooked commercial realities or outdated technology, can turn promising deals into cautionary tales. The real differentiator is now the ability to systematically hunt out these risks before they erode value.

A New Value Equation

The data is clear.

Gain.pro's 2025 Private Equity Value Creation Report [1] shows revenue growth accounts for 54% of total value creation, with multiple expansion and margin uplift contributing just 32% and 14%, respectively. McKinsey and EY confirm the same trend: operational improvements are the primary engine of returns.

This fundamentally reshapes how GPs approach deal sourcing, due diligence, and portfolio management. In a 7% interest rate environment, competitive PE is now an operating sport, not a leverage game.

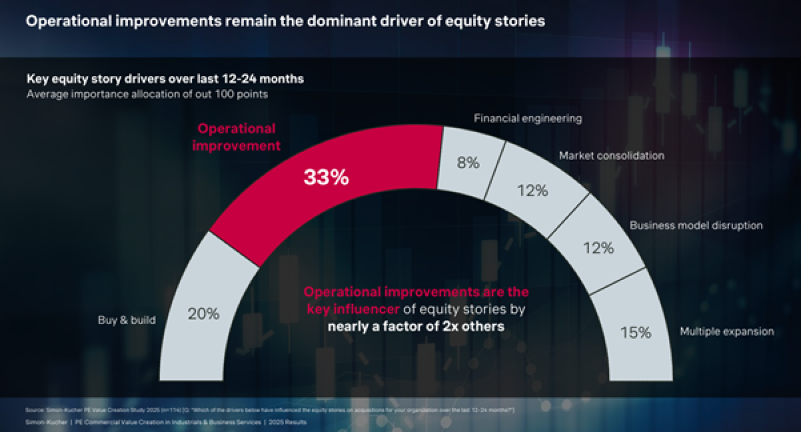

Beyond Financial Engineering

The 2025 Simon-Kucher PE Value Creation Study [2] is unambiguous: financial structuring contributes less than 10% of realised equity gains. Pricing power, organic growth, and operational excellence do the heavy lifting.

Firms that outperform transform value creation from craft into disciplined operating systems, powered by data, sector specialists, and repeatable / flexible playbooks.

Private equity has industrialised ingenuity.

From Art to Science

Success requires going deeper.

Traditional due diligence focused on revenue quality and margins is insufficient.

GPs must now ask:

- Where does technology create competitive advantage?

- Where are supply chain inefficiencies?

- What are the root causes of churn?

- How scalable is the business model?

Commercial and technology diligence are non-negotiable strategic levers, stress-testing pricing algorithms, understanding supplier dependencies, and mapping data infrastructure.

Example: Systematic Learning

A lower mid-market PE firm noticed revenue churn spiked 18 months post-acquisition across five platforms, always triggered by overlooked customer retention. They systematically analysed all deals, identified the root cause (cost-cutting prioritised over relationship management), and revised their 100-day playbook. Result: 8-12% MOIC uplift across subsequent investments.

Example: Hidden Tech Risk

A PE firm evaluating a B2B company discovered through specialist diligence that mission-critical software was maintained by a single 62-year-old engineer with no documentation or succession plan. This insight changed the deal model entirely, securing a 20% discount and new resourcing plan before close, not after.

The Hidden Engine: Institutional Memory

What separates outperformers is institutional memory, the ability to systematically learn, codify, and reuse experience across fund generations.

FTI Consulting's 2025 Value Creation Index [3] shows the most resilient firms "industrialise experience, storing it as data, process, and culture."

Gain.pro's analysis found firms applying structured learning loops delivered 33% higher average MOICs than peers treating each deal as standalone.

Building the Flywheel

At its best, institutional memory forms a flywheel of pattern recognition, much like Jeff Bezos's concept of the Amazon Flywheel, where each turn of the wheel amplifies the next.

In PE, each deal teaches the organisation something new; each refined insight accelerates execution on the next investment.

Case Study: Data Infrastructure as competitive moat

A business services platform spent 18 months harmonising customer data post-acquisition, cleaning records, defining standards, building analytics. Their next two add-ons integrated 60% faster, with cross-sell revenue surfacing within months instead of years. The data infrastructure became a genuine competitive advantage.

Top performers embed learning through:

1. Knowledge Bases, not email threads Structured post-mortems feed searchable systems. GPs can query: "What operational risks did we identify in similar deals? Which assumptions held?"

2. Living portfolio dashboards Track operational metrics, revenue per employee, CAC, tech utilisation, correlating them with value creation outcomes to identify what actually moves the needle.

3. Feedback-Driven frameworks Compare diligence assumptions against actual outcomes. Learn that revenue synergies are consistently 30% optimistic, or tech integration costs underestimated by 40%. This is calibration, not pessimism.

4. Cross-Portfolio collaboration One firm's pricing algorithm delivered 12% revenue uplift. They systematised it across five portfolio companies within 18 months, creating $50 million in aggregated enterprise value.

Constructive Paranoia

Apollo and EQT institutionalise "constructive paranoia", dedicated teams stress-test assumptions, run scenario drills, and flag early warnings. They systematically ask:

- If market growth drops 500bps, which businesses are most exposed?

- Which revenue synergies carry highest execution risk?

- What early indicators signal trouble?

This is institutional memory in motion: using knowledge to outthink entropy.

Technology Integration: value creator and destroyer

Value creation stalls without fit-for-purpose technology infrastructure and business-technology alignment. This is not about having software; it is about having the right data architecture to generate actionable insights.

Many PE firms underestimate achieving "single customer view." Integration takes months, requiring both technical infrastructure and operational process redesign.

The real cost of poor data

Integration Failure: A PE firm acquired three B2B companies, spent £2 million and 18 months on integration, yet customer data remained fragmented. Why?

Achieving unified views required answering operational questions first: How do you define customers across different business models?

How do you reconcile order data when fulfilment processes differ?

Integration Success: A B2B commerce platform growing 20% annually had compressing margins. Specialist tech diligence revealed inefficient payment processing losing 2-3% of transaction value. A four-month fix generated $3 million in annual margin expansion, 200bps of EBITDA uplift invisible to financial diligence.

Firms building data infrastructure upfront gain repeatable integration templates. Those starting fresh each time never reach escape velocity, fighting the same battles repeatedly without accumulating advantage.

The Critical Role of specialist diligence

Operational value creation requires deeper, specialist-led analysis beyond traditional in-house diligence.

Where traditional diligence falls short

A SaaS platform might show strong retention and market share. But is the architecture scalable, or held together by technical debt? A manufacturing company might have strong margins, but what about supply chain dependencies, inventory turns, automation opportunities?

Skipping rigorous commercial and technology diligence is a direct path to value destruction. Surface-level reviews miss customer concentration, pricing inflexibility, supply chain weaknesses, legacy dependencies, integration bottlenecks, and cybersecurity faults.

Creating Value through specialists

Specialist diligence creates value by examining:

- Technology architecture: Technical debt, scalability constraints, cost reduction opportunities

- Commercial sustainability: Pricing power, customer concentration, revenue quality beyond headlines

- Operational scalability: Automation, process optimisation, integration potential

- Data infrastructure: Integration costs, governance requirements in buy-and-build scenarios

- Organisational risk: Key person dependencies, knowledge silos, capability gaps

Engaging specialists pre-deal surfaces critical risks before term sheets are signed. This intelligence becomes institutional memory and competitive advantage.

From Intelligence to Action

Pre-Investment: Early specialist engagement provides operational intelligence for better entry decisions. Patterns across multiple deals inform future origination strategy and value creation planning.

Post-Investment: Specialist findings become Year 1 priorities. Fragmented data requiring harmonisation gets budgeted and resourced from Day 1, not discovered as a crisis mid-hold.

Framework: Operationalising Learning

The PE firms winning in 2025 and beyond follow five disciplines:

1. Systematic Capture Structure post-mortems into searchable systems, templates feeding knowledge databases, not email threads.

2. Data-Driven Analysis Aggregate patterns across deals, periods, geographies. Dashboard performance tracking reveals what moves MOIC.

3. Codification Turn insights into repeatable processes, screening frameworks, diligence playbooks, sector-specific 100-day plans.

4. Distribution Universal access for entire deal teams. No insight hoarding. Junior analysts should query institutional knowledge instantly.

5. Iteration Each deal is both value creation and data point. Post-mortems refine models on every cycle. This is discipline, not sophistication.

Why Learning is the last sustainable advantage

In a landscape of geopolitical risk, AI disruption, regulatory change, and macro shocks, the ability to learn faster than external volatility unfolds drives consistent outperformance.

Success is no longer about who closes first, it is about who remembers best, reacts fastest, and executes most intelligently. The difference between value creation and destruction lies in recognising leading indicators before they materialise.

The New PE Playbook

The next decade will be won by firms that:

- Master operational discipline, systematise through frameworks, playbooks, and genuine intervention, not aspiration

- Embed learning infrastructure, outlearn value destruction by turning every deal into a learning laboratory

- Invest early in specialists, commercial and technology diligence separate outperformance from expensive mistakes

- Build institutional memory as moat, capture insights as data, codify as process, distribute across organisations

- Recognise operational excellence as pre-investment requirement, it starts with diligence quality before term sheets

Firms mastering this cycle, where feedback becomes foresight and foresight becomes efficiency, will generate returns and longevity. They will turn complexity into sustainable returns, making institutional memory their moat.

Conclusion

The line between value creation and destruction is thinner than ever. Firms best positioned for success treat every deal as both investment and laboratory, where learnings are codified, risks anticipated, and operational excellence woven through every investment stage.

Institutional memory and specialist diligence are not concepts; they are operational realities setting leaders apart.

In today's private equity landscape, the real differentiator is systematically hunting invisible risks before they erode value, building infrastructure that turns every lesson into lasting competitive advantage.

The firms that will thrive are those that outlearn value destruction, one deal, one insight, one competitive advantage at a time.

Citation:

[1]: Gain.pro, 2025 Private Equity Value Creation Report (2025). Analysis of over 10,000 global PE investments. Available at: https://www.gain.pro/insight-reports/value-creation

[2]: Simon-Kucher & Partners, 2025 PE Value Creation Study: Industrials & Business Services (2025). Available at: https://www.simon-kucher.com/en/insights/private-equity-study-2025

[3]: FTI Consulting, 2025 Private Equity Value Creation Index (June 2025). Survey of 500+ global PE decision makers. Available at: https://www.fticonsulting.com/insights/reports/private-equity-report

Member discussion